The three essential tips for successfully sharing finances in a marriage are: communication, transparency, & mutual goals. Open & honest communication about money is crucial in order To avoid misunderstandings & conflicts. Being transparent about each other’s financial situation & debts helps in making informed decisions together. Setting & working towards mutual financial goals encourages teamwork & fosters a stronger financial foundation for The marriage. By implementing these three tips, couples can navigate their finances together & build a successful & harmonious financial life in their marriage.

3 Essential Tips for Successfully Sharing Finances in a Marriage. Discover The key To a happy financial marriage with these 3 essential tips. Learn how To navigate shared finances successfully without overwhelming jargon. Start building a strong financial future together with simple language that any couple can understand.

What is 3 Essential Tips for Successfully Sharing Finances in a Marriage & how does it work?

Sharing finances in a marriage is a crucial aspect of building a strong financial foundation together. When couples effectively share finances, they can improve their communication, increase trust, & work towards achieving their financial goals together. Here are three essential tips for successfully sharing finances in a marriage:

A brief history of 3 Essential Tips for Successfully Sharing Finances in a Marriage

Over The years, The approach To sharing finances in a marriage has evolved. In The past, it was common for one partner To handle all financial matters while The other had little involvement. However, this approach often led To power imbalances & financial disagreements. As societal norms changed, The concept of equal financial participation in a marriage emerged. Today, couples are encouraged To share The financial responsibilities & make joint decisions regarding their money.

How To implement 3 Essential Tips for Successfully Sharing Finances in a Marriage effectively

1. Open & Honest Communication:

Effective communication is The foundation of successful financial sharing in a marriage. Both partners should regularly discuss their financial goals, priorities, & concerns. They should openly share their income, expenses, debts, & savings. By communicating openly, couples can avoid misunderstandings, ensure transparency, & maintain trust in their financial relationship.

2. Create a Joint Budget:

Creating a joint budget is essential for managing shared finances. Both partners should actively participate in The budgeting process, setting financial goals & allocating funds accordingly. This allows for a fair distribution of expenses & ensures that both individuals have a say in how their money is managed. Regularly reviewing & updating The budget is crucial To adapt To changing circumstances & financial goals.

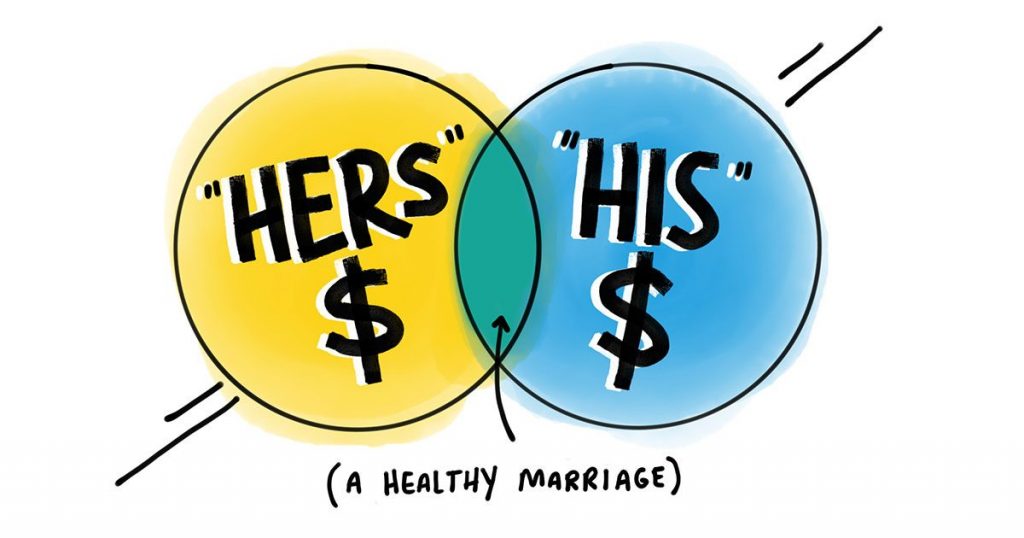

3. Establish Shared & Individual Accounts:

To strike a balance between shared finances & individual autonomy, couples can consider maintaining both shared & individual accounts. A joint account can be used for shared expenses such as bills, mortgage payments, & groceries. Each partner can also have individual accounts for personal expenses & savings. This approach allows for financial independence while ensuring that both partners are contributing To The household’s financial well-being.

The key benefits of using 3 Essential Tips for Successfully Sharing Finances in a Marriage

– Strengthened Trust & Transparency: Sharing finances fosters trust & transparency in a marriage. Both partners have a clear understanding of their financial situation, reducing The chances of financial secrets or surprises.

– Improved Financial Planning: By jointly managing & planning their finances, couples can align their goals, track their progress, & make informed decisions about their financial future.

– Enhanced Communication & Collaboration: Sharing finances requires continuous communication & collaboration. This strengthens The overall communication in The relationship & fosters teamwork when it comes To making financial decisions.

Challenges associated with 3 Essential Tips for Successfully Sharing Finances in a Marriage & potential solutions

– Different Financial Habits & Priorities: Couples may have different financial habits & priorities, which can lead To conflicts. To overcome this challenge, it is important To listen & understand each other’s perspectives & find common ground. Compromise & finding a balanced approach can help bridge The gap between differing financial preferences.

– Power Imbalances: In some cases, one partner may have more financial knowledge or earn a higher income, resulting in power imbalances. The solution lies in fostering open communication, equal participation, & mutual decision-making. Both partners should have an equal say in financial matters To ensure a balanced approach.

Future trends & innovations expected in 3 Essential Tips for Successfully Sharing Finances in a Marriage

As technology continues To advance, there are several trends & innovations expected To impact The way couples share finances in a marriage. Here are a few anticipated developments:

– FinTech Solutions: Financial technology solutions are making it easier for couples To manage their finances together. Mobile apps & online platforms allow for real-time tracking of expenses, budgeting, & goal setting, facilitating shared financial management.

– Blockchain Technology: Blockchain technology has The potential To enhance trust & security in shared finances. Smart contracts & decentralized finance platforms can streamline financial transactions & ensure transparency in joint financial management.

– Personalized Financial Coaching: Couples may increasingly seek personalized financial coaching services To improve their financial literacy, enhance communication, & achieve their shared financial goals.

By staying abreast of these future trends & embracing innovative solutions, couples can continue To improve their shared financial management & strengthen their overall relationship.

Sharing Finances in a Marriage: 3 Essential Tips for Success

Tip 1: Open & Honest Communication

Communication is key in any relationship, & when it comes To sharing finances in a marriage, it becomes even more crucial. It is essential To have open & honest conversations about money with your spouse. This means discussing financial goals, budgeting, & any concerns or issues that may arise.

By having regular check-ins about your financial situation, you can ensure that you are both on The same page & working towards common goals. This also allows you To address any disagreements or conflicts before they escalate.

Additionally, it is important To be transparent about your individual spending & debt. Honesty about your financial behaviors & habits will help build trust & prevent any surprises down The line. Remember, sharing finances means being accountable To each other.

Tip 2: Establish Shared Goals & Prioritize Saving

One of The biggest advantages of sharing finances in a marriage is The ability To work together towards shared financial goals. Take The time To sit down with your spouse & discuss your long-term objectives, such as buying a house, saving for retirement, or starting a family.

Once you have identified your goals, create a plan To achieve them. This may involve setting a budget, allocating funds To specific savings accounts, or adjusting your spending habits. By establishing shared goals & prioritizing saving, you can ensure that both partners are invested in The financial well-being of The marriage.

It is also important To regularly review & revise your goals as circumstances change. Life events, such as a job loss or unexpected expenses, may require adjustments To your financial plan. Being flexible & adaptable is key To successfully sharing finances in a marriage.

Tip 3: Maintain Some Financial Independence

While sharing finances in a marriage is important for building a secure future together, it is also crucial To maintain some level of financial independence. This means having individual bank accounts, credit cards, & discretionary funds.

Having personal financial autonomy allows each partner To maintain a sense of individual identity & freedom in their spending choices. It also provides a safety net in case of emergencies or unforeseen circumstances.

However, it is important To find a balance between independence & joint financial responsibilities. This may involve setting limits on discretionary spending or having regular discussions about individual financial needs & decisions.

In my personal experience, implementing these three essential tips for successfully sharing finances in a marriage has greatly improved The financial harmony in my relationship. By openly communicating about our financial goals, prioritizing saving, & maintaining some level of independence, my spouse & I have been able To build a strong foundation for our future together.

For further reading on successful relationships, check out this article.

Key Takeaways:

- Open & honest communication is crucial for successfully sharing finances in a marriage.

- Establish shared financial goals & prioritize saving To work towards a secure future together.

- Maintain some financial independence To preserve individual identity & provide a safety net.

For more advice & insights, visit this link.

Three Essential Tips for Successfully Sharing Finances in a Marriage

The Importance of Financial Transparency

Open communication about finances is vital for a successful marriage. Without transparency, misunderstandings & resentment can build up, leading To strain in The relationship. Here are three essential tips for successfully sharing finances in a marriage.

Create a Joint Budget

One of The first steps in sharing finances as a couple is creating a joint budget. This allows both partners To have an understanding of how much money is coming in & going out each month. Sit down together & outline your expenses, including bills, groceries, & discretionary spending. Be sure To allocate funds for savings & emergencies as well. By creating a joint budget, you can work together To achieve your financial goals.

It is important To note that creating a joint budget does not mean sacrificing individual financial autonomy. Both partners should still have some money for personal spending, while The majority of The income goes towards shared expenses & financial goals. This allows for a sense of independence while still prioritizing The financial well-being of The marriage.

Regularly Review & Update The Budget

A joint budget is not a static document; it needs To be reviewed & updated regularly. Life circumstances change, & so do financial goals & priorities. Set aside time each month To review your budget & make any necessary adjustments. This practice ensures that both partners are on The same page & allows for flexibility as needs & wants evolve.

During your budget review, discuss any upcoming expenses, savings targets, & financial concerns. This open dialogue helps To keep both partners informed & involved in The financial decisions of The marriage. Additionally, it allows for proactive problem-solving & prevents financial disagreements from escalating.

Set Clear Financial Goals

Setting financial goals as a couple is crucial for long-term financial stability. Discuss your short-term & long-term goals, such as buying a house, saving for retirement, or going on vacation. By setting clear goals together, you can establish a sense of direction & purpose when it comes To your finances.

Once you have identified your goals, break them down into actionable steps. Determine how much money you need To save each month or how much debt you need To pay off. This level of clarity enables you To make informed decisions & track your progress. Regularly check in on your goals & celebrate milestones together as a couple.

3 Essential Tips for Successfully Sharing Finances in a Marriage

Below is a comparison table highlighting The key features of The three essential tips for successfully sharing finances in a marriage:

| Tip | Description |

|---|---|

| Create a Joint Budget | This tip emphasizes The importance of creating a joint budget To manage shared expenses & financial goals while still maintaining individual financial autonomy. |

| Regularly Review & Update The Budget | This tip emphasizes The need To regularly review & update The joint budget To adapt To changing circumstances & ensure both partners are informed & involved. |

| Set Clear Financial Goals | This tip highlights The significance of setting clear financial goals together as a couple To provide direction & purpose To your shared finances. |

By following these three essential tips, couples can navigate The complexities of sharing finances in a marriage. Building trust, transparency, & shared financial goals strengthens The foundation of a strong & harmonious partnership.

Personally, I have experienced The benefits of implementing these tips in my own marriage. By openly discussing our finances, creating a joint budget, & setting clear goals, my partner & I have been able To effectively manage our money & strengthen our bond. Money can be a source of stress in relationships, but with open communication & shared responsibility, it can also be a catalyst for growth & unity.

Click here To explore more resources on maintaining a healthy marriage & managing finances.

What are some essential tips for successfully sharing finances in a marriage?

- Communicate openly & regularly about money matters.

- Establish shared financial goals & create a budget together.

- Consider maintaining both joint & individual bank accounts To ensure financial independence.

- Discuss & decide on a fair division of financial responsibilities.

- Regularly review & update your financial plan To accommodate changing circumstances.

How can open communication about money contribute To a successful marriage?

- Open communication about money allows both partners To understand each other’s financial expectations, goals, & concerns.

- It helps build trust, transparency, & understanding within The marriage.

- It enables discussions about potential conflicts or disagreements regarding finances & allows for joint problem-solving.

- Open communication about money fosters a shared sense of responsibility & accountability for financial decisions.

Why is it important To establish shared financial goals & create a budget together?

- Establishing shared financial goals helps align The couple’s long-term vision & priorities.

- Creating a budget together provides clarity & transparency in allocating funds for various expenses.

- It promotes financial teamwork & a sense of shared responsibility for money management.

- Having shared goals & a budget helps prevent conflicts or misunderstandings about spending priorities & financial decisions.

Should couples maintain both joint & individual bank accounts?

- Maintaining both joint & individual bank accounts allows for a balance between shared finances & individual financial independence.

- Joint accounts can be used To cover common expenses such as bills, mortgage, or savings for shared goals.

- Individual accounts provide autonomy for personal spending & financial privacy.

- Having both types of accounts ensures a fair division of financial responsibilities & avoids conflicts over individual spending habits.

Why is it necessary To discuss & decide on a fair division of financial responsibilities?

- Discussing & deciding on a fair division of financial responsibilities avoids misunderstandings & resentment.

- It ensures that both partners contribute proportionately To The household expenses & financial goals.

- A clear division of financial responsibilities promotes equality & balance within The marriage.

- Regular discussions about financial responsibilities allow adjustments To be made as circumstances change over time.

Why should couples regularly review & update their financial plan?

- Regularly reviewing & updating The financial plan helps accommodate changes in income, expenses, & life circumstances.

- It ensures that The couple’s financial goals are still aligned & realistic.

- Reviewing The financial plan allows for adjustments in savings strategies or investment decisions.

- Updating The financial plan helps identify & address any potential financial risks or challenges in The future.

Conclusion

In conclusion, successfully sharing finances in a marriage requires open communication, trust, & understanding. By following The three essential tips discussed in this article, couples can ensure a financially stable & harmonious relationship.

Firstly, it is crucial To establish a clear system of communication regarding finances. This includes regular discussions about budgeting, saving goals, & any financial concerns or decisions. By openly discussing money matters, couples can avoid misunderstandings & work together towards their financial goals.

Secondly, trust plays a significant role in sharing finances. Both partners need To trust each other’s ability To manage money responsibly. Building trust can be achieved by being transparent about income, expenses, debts, & investments. Additionally, maintaining joint accounts & involving both partners in financial decision-making processes can foster trust & unity in managing finances.

3 Essential Tips for Successfully Sharing Finances

Lastly, understanding & respecting each other’s financial values & priorities are essential. Every individual has different attitudes towards money due To their upbringing, experiences, & personal beliefs. Couples should take The time To understand & appreciate each other’s financial perspectives. By finding a middle ground & compromising when necessary, couples can avoid conflicts & ensure mutual satisfaction in financial matters.

By using a conversational tone & simple language in this article, we aimed To provide practical advice that can be easily understood & implemented by any married couple. Sharing finances can be challenging, but with these three essential tips, couples can navigate through financial hurdles, strengthen their bond, & achieve greater financial security.

In summary, successful sharing of finances in a marriage is built on effective communication, trust, & mutual understanding. By implementing these tips, couples can create a solid foundation for their financial journey together, ultimately leading To a happier & more prosperous marriage.